*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

Monthly Budget Plan For Family Of 4 Making 50k

Creating and keeping a monthly family budget in mind can be hard for some people. We’ll try to break it down to help you get familiar with the process. Heck, we are all new at some point in our lives.

Having a budget plan for a family of 4 making 50k is even more important to save money and stay on track. If you’ve got four in your family budget then chances are there are kids. With kids there’s no way around it, you need to be careful with your money.

Having a well-thought-out and planned budget will help you all make better spending decisions. You’ll be able to do things like avoiding unnecessary fees or expenses that otherwise sneak up on you. They do too! Those rate hikes, add-ons add up just when you start to relax on checking up on your budget.

We’re offering you some simple steps to create your own family monthly budget plan. We’ll do this based on your current income level and expenses.

The first step is to start tracking all of your expenses before creating your plan to get an accurate idea of how much money you actually spend each month. These will be things like groceries, utilities, entertainment, etc.. Part 2 is making a list of all monthly expenses such as rent/mortgage, car payments, loans, property taxes, etc. Then we’ll go through how to realistic limits for yourself so that you don’t overspend throughout the year.

Some Of What We Will Cover For Your 50k Family Budget Plan:

- How realistic a 50k budget for a family of four is and can you really even make it on that?

- Tackling your money like a boss by budgeting and making cuts, also some savings tips that add up in a big way

- Knowing where your money is going now and where it should be going

- What a Zero-based budget is and if it’s right for you

- and references, tools to help you along the way

Is It Realistic To Think A Family Of Four Can Survive On 50k?

I’ll be honest here. A budget for a family of four making 50k can be done. It’s not going to be easy and you certainly won’t be “keepin’ up with the Joneses” You’ll need to commit to a strict spending plan and make smart choices at every corner.

We’re going to practice ‘a place for every penny and a penny in it’s place’.

Where Does All The Money Go?

You’ll need to know where all your money is going. You may think you do, but I’m betting there are details you either didn’t see or chose not to acknowledge in your family spending habits. We’ll want to look at ALL your expenses to create your family budget plan.

Do We Really Need A Monthly Family Budget?

Yes, everyone needs a monthly family budget. A budget for a family of 4 making 50k is no exception. If anything, you need this family budget plan more than most.

How Can A Family Budget Plan Make A Difference?

A family budget plan can help you know where your money is going, what is due when and even find ways to save towards future goals, big and small.

A budget plan is there to let you know where every penny’s place is. You’ll find ways to live and enjoy a life that isn’t filled by only material things, how to thrive as a family with common goals.

Where To Start With Your Monthly Budget Plan For A Family Of Four

The first step is to start tracking all of your expenses before creating your plan to get an accurate idea of how much money you actually spend each month. These will be things like groceries, entertainment, school supplies, etc.. Part 2 is making a list of all monthly expenses such as rent/mortgage, car payments, loans, property taxes, etc. Then we’ll go through how to realistic limits for yourself so that you don’t overspend throughout the year.

Once you start this process you are on your way to starting your family of four budget plan.

Know Your Net Income Making $50k/Year

Your salary is 50k but what is your ‘net income’ , your take home pay? Let’s say you just accepted a job offer for 50k and you want to calculate what your net income is.

On average you want to estimate 25% taken out of your paycheck. Leaving you with 75% take-home pay. However, this can vary state by state and also may include things like union dues, so check your state’s taxes, how many you claim, etc. A good free tool to use is ADP’s income calculator.

Using the 70% take home calculation your annual living income is:

| Annual Salary | Estimated Taxes | Take Home % | Working Take Home Wage (Net Annual Income) |

|---|---|---|---|

| $50,000 | 25% | 75% | $37,50 |

For a monthly family budget plan, you want to clearly understand your income as clearly as possible. There are 12 months in a year, 52 weeks a year right? Your monthly take-home pay is based on this average of 4.33 weeks x 12 months.

| Annual Take Home Wage (Net Montly Income) | Divided by 4.33 Weeks a Month | = | Monthly Take Home Pay (Net Monthly Income) |

|---|---|---|---|

| $37,500 | /12 | $3,125 | |

Weekly Net Income based on 70% take home would be:

| Annual Take Home (Net Income) | Divide by 52 weeks | = | Weekly Take Home (Net Income) |

|---|---|---|---|

| $37,500 | /52 | $ 721.15 | |

“The Favored Four,” First Things First:

Your primary focus is going to be on your ‘necessities’ or some call, your needs. Your ‘absolute’ need to survive expenses. Below are what we call the ‘Favored Four’ A large part of your net income will be going towards these.

- Food

- Housing

- Transportation

- Utilities

These are the focus areas for to budget for family of 4 making 50k or even making 200k, your favored four are the primary important expenses in your monthly family budget plan.

How Much House/Rent Can I Afford On A $50k Salary?

What you can afford vs what you actually pay is often a huge factor in getting into debt. You need to clearly commit to following the standards for housing affordability.

There are different approaches and different factors involved. Housing costs vary drastically across the U.S. and can vary substantially within a state depending on the part of your state or even just the part of your town.

We’re covering the 30% rules, the 28/36 rule as well as your debt to income ratio, and how that can impact what you can afford.

How To Calculate The Largest Expense For A Family Of 4

First up you must calculate your debt to income (DTI) ratio and percentage of your income is available for housing costs.

The debt to ratio income calculates based on your current debt divided by your gross income. The banking standard is to calculate based on your gross pay vs your monthly expenses. They use this number to determine what the risk is to lend to you.

To do your own calculation of Debt to Income, I use Omni Calculator all the time.

To most accurately budget for a family of 4 making 50k and create your family budget plan we are going to use your Net Income in our calculations.

The Standard Rule Of Thumb For Housing Expense

- 30% is the commonly referred standard.

- Explanation / Examples of debt:

- Debt to Income (DTI)

No denying it, on a 50k budget and with a family of four, you need to keep your highest expense in check. You need to know what your allowing yourself in housing costs up front. Time to get real.

The standard 30% rule is to help you keep your family safe from failure. I know many who go way over this rule, but they also have side hustles throughout the year that balance out the regular weekly net income. This may be something you will want to consider, but I’d caution that you use additional income to grow your emergency fund and pay down debt first.

Let’s take a look at what the 30% rule says you should aim for with your rent or mortgage.

| Net Monthly Income | 30% Rule | = | Available for Rent or Mortgage |

|---|---|---|---|

| $3,125 | x .30 | $937.50 | |

Then there’s the 28/36 rule. This is based on your debt to income ratio (above). The rule is based on spending no more than 36% of total in debt. So, let’s say you have NO debt you can consider going higher than the 28%. CAUTION: Your debt could change in a minute if you’re not vigilante at the drop of one emergency!

If you have a well established and respectible amount in savings AND minimum 6 months in your emergency fund then you are on the safer side of going a bit closer to the 36% side. Please be honest with yourself and anticipate any possible scenario that could tumble into your finances.

Remember, we are using your take home pay monthly of $3,125 for these calculations. You also want to calculate your debt to income ratio.

Debt divided into Income

| Debt Amount | Divided by Net Monthly Income | = (equals) | % of Debt |

|---|---|---|---|

| $ 150 | / $3,125 | = | 5% (i rounded up from 4.8%) |

Using the above debt percentage, you would deduct your 5% debt from the 36% (no debt) calculation. Leaving you 31% available for rent or mortage. Again, I caution against using anything above 30% as debt is a sneaky character and can devastate a family budget. Always be on your guard and as prepared as possible.

Based on the 28/36 rule here would be your funds available for rent or mortgage:

| Monthly Net Income | % Monthly Towards Housing Cost (Rent or Mortgage) | Multiply Net Income to Calculate (using these numbers below) | = (equals) | Income Available for Rent or Mortgage |

|---|---|---|---|---|

| $3,125 | 28% | income x .28 | = | $ 875.00 |

| 29% | x .29 | $ 906.25 | ||

| 30% | x .30 | = | $ 937.50 | |

| 31% | x .31 | = | $ 968.75 | |

| 32% | x .32 | = | $1000.00 | |

| 33% | x .33 | = | $1031.25 | |

| 34% | x .34 | = | $1062.50 | |

| 35% | x .35 | = | $1093.75 | |

| 36% | x .36 | = | $1125.00 | |

| = |

The Second Largest Expense For Most Families: Transportation

Transportation expenses can vary greatly depending on how many are working in your family, is work accessible by bus, train (still an expense), parking costs, etc. Then add in maintenance, insurance, fuel and possibly a car loan (I hope you counted that as debt when calculating your rent or mortgage)

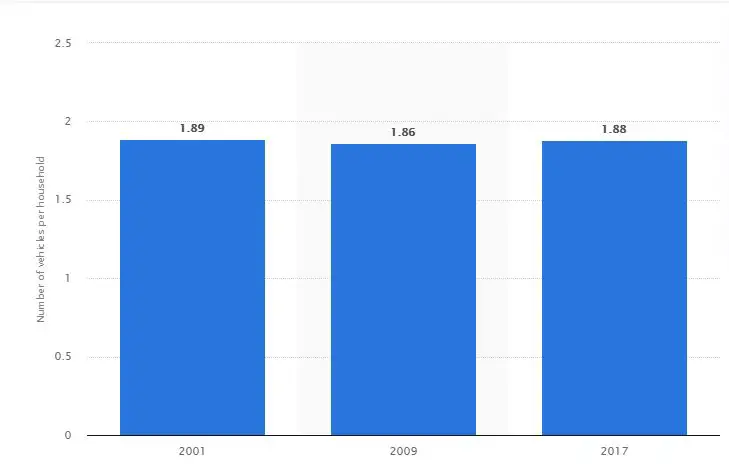

How many cars does the average american family own? According to Statista, the number has been 1.88 since 2001.

How are you going to budget for family of 4 and be able to afford transportation? You’re going to keep it realistic. One Car Family is how.

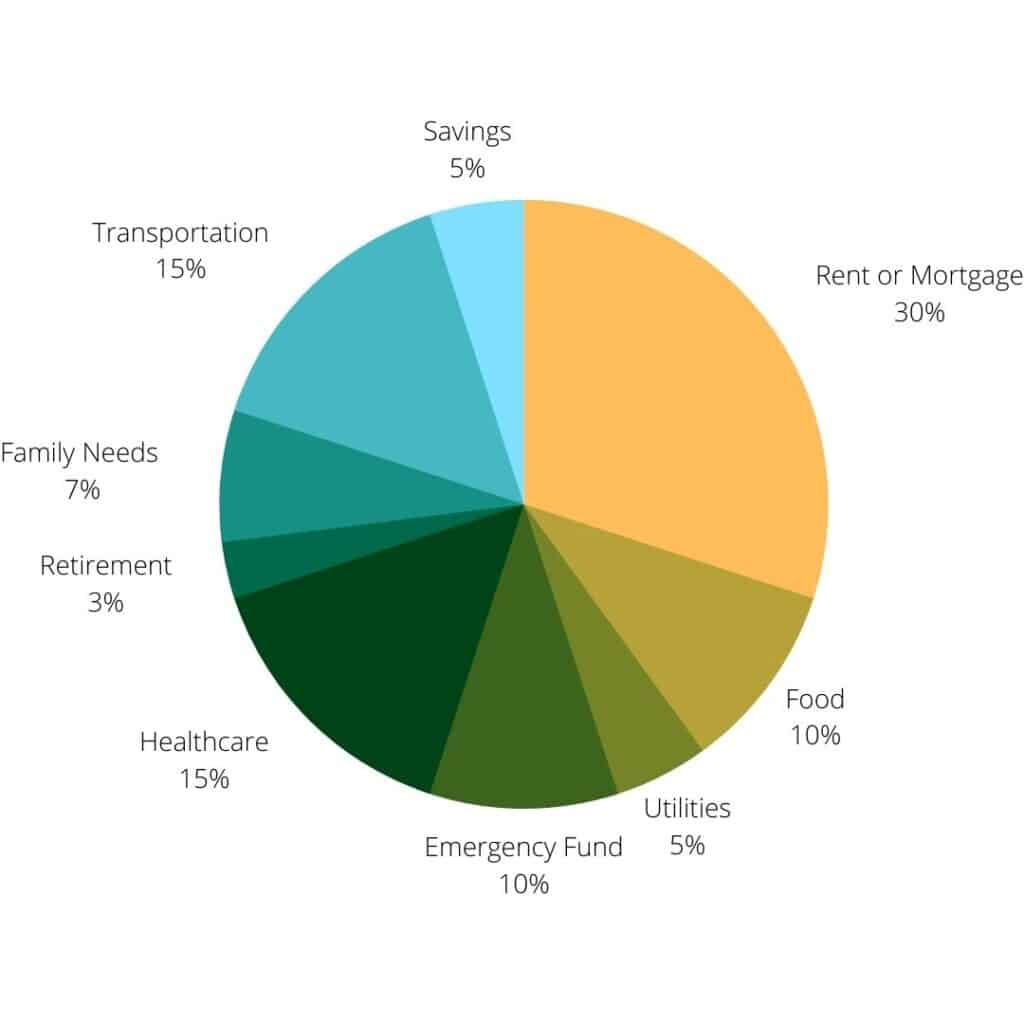

Your family budget plan allows for 15% of your net monthly income for transportation (this includes maintenance, fuel, etc.)

| Monthly Net Income (take home pay) | 15% Transportation Budget | = (equals) | TOTAL ALLOWABLE TRANSPORTATION EXPENSE MONTHLY |

|---|---|---|---|

| $3,125.00 | x .15 | = | 468.75 |

You’ve just completed part two of your monthly family budget plan! woohoo, we’re on our way. Believe it or not those are the two highest amounts. But we all know, it’s the nitty gritty that gets us, so we’ll try to dig into this in a manageable way as we move forward.

Monthly Food Budget For A Family Of Four Making $50k

Dig out the recipes, grandma’s favorite tips n kitchen tricks. Get out the calendar too! You’re about to really rock this monthly food plan. Meal planning is going to be your saving grace. Be flexible around the plan, but having this will keep you on track and quite likely finding added savings!

We are going to allow 10% for your budget plan for a family of four making 50k here. I think you can do better and can’t wait to see you prove me wrong!

| Monthly Net Income (take home pay) | 10% Family Food Budget | = (equals) | Monthly Food Budget |

|---|---|---|---|

| $3,125 | x .10 | = | $312.50 |

Eating At Home, Packing Lunches, Eating Healthy

Let’s face it if you’re comitted to making a budget for family of 4 making 50k it’s absolutely do-able. Your food budget is one of those areas wehere you have great potential to stretch the almighty dollar and get creative.

- Eating at home not take out, the new ‘going out to eat is when friends or family invite you over for a cookout or dinner! (actually, this family budget plan is starting to sound fun)

- Pack your lunch for work, trips to the (free) playground, park, playdates.

- Eat healthier unprepared foods, you’ll feel fuller, eat better and save tons!

- Clip those coupons honey, all of them!

- Shop the Sales, change stores if you’re able to find a local better option for shopping.

- Meal Plan around the foods on sale and what’s in your pantry.

- Leftovers are for everyone! Get creative.

- Food stores have day old (do you ever eat an entire loaf of bread in one day?), dinged and dented fruits n veggies. Many of these can be frozen for future use too.

- Bigger isn’t always cheaper. Check the per ounce/ per pound/ unit price.

- I shop Walmart online 1x/mos for certain non-perishable items and toiletries. I find ‘my budget’ price and once I hit $35 shipping is free (no membership fee). It’s saved me time AND money knowing where I get my better prices.

- If you have space or access to some, grow a garden and freeze some of your harvested goods.

I am passionate about saving on my food and household toiletries budget, so I’ll stop here and not overwhelm you with my ramblings of all the savings I’ve scored! I’ll just say here, I know with all my hear you can totally do better than your 10% monthly family food budget.

Monthly Utilities Expenses For A Family Of 4

Getting to know your energy usage and expenses can be done a few ways.

- Take all your bills from last year and total each one by company.

- Call each company and ask if they offer an energy audit (this could get you a whole bunch of free energy-efficient stuff too!)

- If you are new to your home, call energy company and ask what the average usage and bill was for the previous occupants, also ask if this is high, low, median.

As climate can change our energy usage from year to year, you want to aim for the budget that’s ‘middle of the raod’ but strive for less whenever possible.

We are allocating 5% of your monthly net income (take home pay to your utilities for a budget for family of 4 making 50k

Here is what your monthly utility budget is

| Monthly Net Income (take home pay) | 5% Family Utilities Budget | = (equals) | Monthly Utilities Budget |

|---|---|---|---|

| $3,125 | x .05 | = | $156.25 |

Utilizing Budget Billing/Cost Averaging To Avoid Seasonal Spikes

- Ask each provider if they offer a budget plan so that you may spread out payments equally throughout the year

If they offer this be sure to check the terms. You don’t want to be caught off guard with any fees or penalties for under payments.

Whenever possible try to keep your monthly budget family of 4 making 50k as consistent as your income is right now. Knowing month to month is helpful and offers a lot of peace of mind.

When you can’t, you need to remember that the balance in your bank statement includes future ‘peak months’ for utilities, heating/cooling, etc.

Building An Emergency Fund And Paying Down Debt

This may not be the highest item in your budget for contributing to, however it is certainly the most important. Having an emergency fund can make or break your budget and mean the difference of recovering from a financial emergency in months or a lifetime. Do NOT ignore this expense you owe. This is your financial insurance policy.

Everything you need to know about Emergency Funds can be found in this article:

Must Read: Emergency Funds, What They Should and Should Not Be Used For

Let’s face facts, your budget for family of 4 making 50k is tight, Until you are able to save 6 months of expenses you need to put 10% into this fund, more if money frees up elsewhere or with gifts or tax refunds. To survive your family budget plan long term we have to protect your future, which could bring unexpected urgent expenses. The good news is you’ll feel better know it’s there and hopefully never have an emergency in your life. You can also see that once this is fully funded you’ll be able to move the amount into savings and saving for goals and some ‘wants’ too.

Here’s your emergency fund budget to add to your monthly family budget plan.

| Monthly Net Income (take home pay) | 10% Emergency Fund Budget | = (equals) | Monthly Emergency Fund Budget |

|---|---|---|---|

| $3,125 | x .10 | = | $312.50 |

Healthcare Budget Plan For A Family Of 4 Making $50,000

Healthcare has seen it’s day in the U.S. my personal opinion is we are all being robbed by the insurance companies or someone here. Maybe it’s what they’ve had to pay to hospitals and drug companies. Certainly people living longer now contributes to longer care needed by insurance companies.

I could rant for a while on this but honestly, the bottom line is we literally in most cases can’t survive financially without health insurance. The cost of care is simply too much for almost every American.

Hopefully you have an employer(s) that offer a great health plan and pay a large portion of this. Probaby not for most. So, being you only make $50k and have a family of four, you most likely qualify for government subsidized insurance. Meaning you can buy at a reduced rate.

You’ll need to check out the government healthcare website and see which you qualify for and what best suits your family’s needs. Even if your company offers insurance, you should compare prices using this site as well. You may just find more healthcare savings. Go to HealthCare.gov

Budgeting For Medical, Dental, And Vision Insurances

Most insurance plans will have co-pays and/or deductibles as well as out of pocket expenses. There are prescriptions to consider as well.

Check with your employer and see if they have an FSA plan for health care. If they do, you may be able to pre-deduct from your pay some of the anticipated out of pocket expenses. This allows for anything you pre-deduct into this account to be tax free.

For example: Prescription cost $25.00 You pay with your FSA benefits card, it is an eligible expense therefore qualified. You have now anticipated your healthcare needs for the year and saved by not having to pay taxes on those estimated expenses. Definitely worth checking into and for most, signing up ASAP.

Your monthly healthcare budget is

| Monthly Net Income (take home pay) | 15% Health Insurance Budget | = (equals) | Monthly Health Insurance Budget |

|---|---|---|---|

| $3,125 | x .15 | = | $ 468.75 |

Retirement Savings: How Much Should Be Set Aside On A $50k Budget

“Some Day” comes before you know it. Don’t get caught wondering how you’re going to live when you retire and never assume you’ll be working when you’re 99 either. It’s just simply not realistic. Sure, it happens but the majority of Americans eventually retire. Start saving now, it adds up and compounds nicely if invested in a retirement fund.

Taking Advantage Of Contribution Matching If Available

Hopefully you have a job where the company offers contributions to your 401k or 403b plan. Even if they don’t you can set up your own retirement fund. As a rule start out with 3% on your part, then increase with each pay increase you receive.

Your budget plan for retirement will be 3% for now (increase with pay increases)

| Monthly Net Income (take home pay) | 3% Retirement Budget | = (equals) | Monthly Retirement Budget |

|---|---|---|---|

| $3,125 | x .03 | = | $ 93.75 |

Family Entertainment Budget Including Eating Out

Eating out isn’t in your budget. Remember, we have priorities to take care of first. You need to get that emergency fund in order. Once that happens you’ll have a bit more flexibility with your budget and ‘non-essentials’ In the meantime, all is not lost.

- Accept an invitation to a friend’s party, bring a side dish, and enjoy (probably much more fun) dinner out.

- Basic Cable TV only, use nothing or just internet to stream. Cable will occasionally offer ‘free’ weeks for premium channels, binge-watch the heck out of these for family ‘movie’ nights!

- Gifts – you’re ‘frugal’ now, you can find items you can hand make special to the person, grow a plant just for them, bake a batch of cookies

- Clothing can be bought or inherited 2nd hand / gently used, on clearance as needed.

- Hair cuts don’t need to break the bank. Find an affordable place locally or a friend who is talented, score the best deal you can for your entire family.

Your Entertainment and Personal care monthly family budget plan is:

| Monthly Net Income (take home pay) | 10% Retirement Budget | = (equals) | Monthly Retirement Budget |

|---|---|---|---|

| $3,125 | x .07 | = | $ 218.75 |

Savings and Future Goals

We all have dreams. Dreams of owning our own home, remodeling that ugly bathroom, having a family vacation to create memories to last a lifetime. Regardless of what they are, big or small, most often they take money. Living on a tight budget and making all the cuts and adjustments you’ve made along the way doesn’t mean you have to give up on those, just be more determined.

Savings is always an important part of budgeting and even more so when you’re creating a budget for your family.

Your monthly family budget plan alots for investing in your dreams and goals too! 5% monthly will make a nice dent!

| Monthly Net Income (take home pay) | 5% Savings Budget | = (equals) | Monthly Savings Budget |

|---|---|---|---|

| $3,125. | x .05 | = | 156.25 |

The Point Of A Zero Based Monthly Family Budget

What is a zero based budget you ask? Well, pretty much what we have been doing above. A zero based budget assigns every cent to a purpose in your budget. By doing this you have no doubts your budget balances each month!

Every Dollar Has A Purpose And Is Spoken For.

Let’s face it, most budgets and especially when you budget for a family of 4 making 50k (or any amount for that matter) you should always know where your money is going.

Every penny in it’s place and a place for every penny.

Benefits of Zero Based Budgeting are:

- It is a clearly defined purpose for each and every dollar in your family budget plan.

- Clearly sets limits

- Eliminates poor spending habits

- Prepare for retirement

- Eliminates or greatly reduced the financial impact of emergencies

Suggested Reading: 10 Savings Tips (some of my favorites)

More Related Reading:

How To Stop Living Paycheck To Paycheck With No Savings & Start Budgeting!

Tracking Your Spending-Seeing It On Paper Impacts Savings

As you track your spending, reduce poor spending habits and get more comfortable with your new budget, you’re going to notice some great things.

You’ll start to see where you can save more, do better. You’ll be able to set new goals. Once your at zero debt and have an emergency fund fully funded you can make the extra monies available for savings.

Over time you’ll see pay increases and some job changes could offer even better benefits, thus reducing expenses on your end.

This seemingly tight budget can feel scary at first, but you’ll adjust and adapt to a good flow soon and start finding savings in ways you wished you knew much sooner!

Keep your written budget close and review monthly. You’ll benefit from this greatly by knowing where you’re at and where you’re money and goals are.

Documenting Your Progress For Your Budget For Family Of 4 On 50k Using Free Google Budget Sheet.

I love using ‘free’ tools available. Free is always budget-friendly and on-trend, right? Check out this video on how to track your progress as you go through your journey. It’s easy to use, free, and can be used for any budget size, big or small! Bonus, the video is not very long, so you can dig into doing your own budget sheet pretty soon.

How Can You Save Money On A $50,000 Salary?

As mentioned earlier, the best way to cut costs is to reduce unnecessary spending. To help you identify areas where you can trim fat, try using the 80/20 rule. Break down your monthly expenses according to categories such as utilities, entertainment, eating out, gas, cell phone bill, insurance, taxes, etc. Then, allocate the remaining resources evenly among them.

Perhaps you could give up cable altogether and stream movies online via Netflix, Hulu, Redbox, Amazon Instant Video, YouTube, etc.? You could also explore ways to bring your meal costs down.

Try cooking more often and packing lunches to go instead of ordering delivery. Think outside the box.

Also, remember to include recurring expenses in your calculation such as gym membership fees, car lease payments, mortgage principal & interest, property tax, homeowner association dues, annual maintenance costs, homeowners insurance premiums, etc. These are usually lumped under the heading “Other Expenses,” but it helps to separate them nonetheless.

Finally, don’t neglect your 401(k) contributions. Even though they typically cost thousands of dollars per year, they compound faster than regular old bank deposits and offer free access to employer matching funds.

To calculate your contribution amounts, download a 401(k) Fee Checker Tool, plug in your estimated yearly contributions, and select the correct fund options.

It’s easy to underestimate how much you’ll need to contribute to meet your long term investment objectives. A great starting point is to use one of these Investment Checkup Tools to estimate your asset allocation and comfort level.

A final word of advice – if you haven’t already done so, open a Roth IRA account. They provide free brokerage services, charge lower commissions, and offer the highest tax advantages available. Plus, you can easily withdraw money whenever you want without being penalized.

Is 50k Enough To Raise A Family?

It’s been said many times, but it bears repeating — raising children really does take its toll on your finances. The costs associated with bringing up babies include the skyrocketing price of diapers, food, toys, clothing and childcare. According to the U.S. Department of Agriculture (USDA), the average cost per child in 2008 was $10,851. That number doesn’t even begin to account for college tuition or other expenses like travel.

In fact, the USDA found that those who made more than $75,000 had higher-than-average monthly expenditures when compared to families earning less than $30,000 annually.

So what happens if you’re trying to conceive, get pregnant and then find out after the birth of your baby that there just isn’t any room at the inn? You’ll probably be scrambling to make ends meet while also dealing with postpartum depression.

It may seem as though being able to support yourself and one person is all you need, but before you know it, you could end up doing everything from eating Ramen noodles twice a week to selling your possessions so that you can pay rent. If you want to start having kids and you’re currently making 50k a year, you might think “that won’t work.” But let’s look at some numbers and see how much income you actually do need to survive comfortably.

First things first: What exactly does it mean to live comfortably?

Living comfortably means not going into debt or living paycheck to paycheck. For most people this means paying off their credit cards and avoiding high interest loans. If you don’t think you’ve done either of these yet, now would be a good time to review your spending habits. Once you’re comfortable with where your money goes each month, we’ll talk about how much income you should aim to earn.

Now that you understand what living comfortably looks like, here’s an example of why you shouldn’t automatically assume that 50k isn’t enough to support a family.

Say you’re married and both spouses have steady jobs. Together, you bring home 60k per year. Of that amount, $4,000 has already gone toward housing, utilities, transportation, insurance and taxes leaving $2,000. Now say, due to unforeseen circumstances, one spouse loses his job. He/she takes unemployment benefits until he finds another position which pays 80% of his salary. With only 10k remaining, they decide to use it to help cover daycare costs for their two young daughters. While this scenario sounds extreme, it shows how easily unexpected events can cause someone to go deeper into debt.

So how much income do you need to avoid taking such drastic measures?

How Much Is Enough for Your Family?

There are thousands upon thousands of articles online discussing whether you’ll ever truly know the true meaning of happiness. One thing everyone seems to agree on, however, is that money certainly helps. Unfortunately, no matter how rich you become, nothing gives you quite the same feeling as providing food, shelter and security for your loved ones.

When you’re starting a new family, it’s easy to lose sight of that. A big part of becoming responsible adults is learning how to balance responsibilities and desires. Sometimes it feels wonderful to splurge or buy something special for yourself, but remember that you’re building memories with your partner and children.

And that’s priceless.

When you sit down to calculate how much income you’ll need to provide for your family, keep in mind that the goal is to create a solid foundation. Over time, you’ll likely discover ways to save even more. Just remember that whatever you come up with as a realistic estimate is fine.

There’s no right answer, only the correct decision for your individual situation.

If you’re worried about finding a decent paying job, focus on improving your skills through education or volunteer work. Or perhaps you’ve always dreamed of pursuing creative endeavors but never thought you could afford to do so.

Perhaps you simply hate managing your budget. Why not try using Mint.com to track your spending and stick to your budget? Whatever the reason, you owe it to yourself and your future self to succeed.

Conclusion:

When you know where every dollar is supposed to go, a monthly budget plan for a family of four making $50K doesn’t have to be uncomfortable.

For those looking for guidance in determining how much money is enough and those who believe that “enough” may be different from family to family. Some people might need more than others because they have a high-stress job or want to save up for retirement early on; some would say $50k per year can make someone comfortable while others feel their budget needs grow greatly after achieving this phase of their goals.

The key takeaway here? No one size fits all when it comes down to figuring out what you truly desire as well as your definition of “comfort.”

.