*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

How To Stop Living Paycheck To Paycheck With No Savings & Start Budgeting!

Have you ever had a paycheck delay when starting a new job or a ‘check is in the mail’ moment of terror? Pretty on the edge, right? The fact of it all is many of us are living that way as their ‘normal’. Living paycheck to paycheck

What if you were to miss a paycheck or worse, lose your job and have to wait for unemployment or disability benefits to kick in. Unless you’ve lived under a rock this past year you’ve heard THOSE horror stories. So, how many people here in the U.S. are living paycheck to paycheck? It’s pretty scary.

According to a 2020 survey from Forbes the number of people living paycheck to paycheck no savings on hand is is 49%. In a survey by BankRate, nearly 40% of people would need to borrow money to cover an unexpected bill. Even more recently a survey from FNBO shows that 53% of us have zero in savings for an emergency fund. These numbers point directly to our growing society of living paycheck to paycheck no savings on hand or a paycheck to paycheck budget.

Further, when it came to stimulus checks 36% were planning to use this for day to day living expenses. This increases to 41% to planning pay towards of pay off debt.

Of the Americans surveyed they prioritized their 2021 finances (per the FNBO survey):

- 36% say paying off debt.

- 25% say boosting emergency savings.

- 20% say saving for retirement.

- 11% say buying a large ticket item such as a house or a car.

~ Barack Obama

A budget is more than just a series of numbers on a page; it is an embodiment of our values.

Help! Tell Me How To Stop Living Paycheck To Paycheck

If we truly are going to stop living paycheck to paycheck, we have to start to understand what it all means. Exploring ‘What Is Living Paycheck to Paycheck’ and digging into a beginner’s paycheck to paycheck budget. (remember, no one size fits all)

The most basic explanation is: TOTAL INCOME – minus TOTAL OUTGOING = ZERO

Go grab a piece of paper, yes paper! and a pen. Make (3) three columns (for your eyes only)

| TOTAL INCOME | – | TOTAL SPEND/OUTGOING | = DIFFERENCE |

All set? Good. Just keep that sheet aside. However, let it sit in a place you can see it, O.K.?

Let’s move on, we’ll come back here in a bit.

What Does It Actually Mean To Live Paycheck To Paycheck?

Let’s say you worked 40 hours and after taxes you take home $500/wk.

You’ve adjusted your recurring expenses to fit perfectly into that paycheck.

You can see in the example below there is no room for a car repair, Health Emergency, vacations or birthdays either.

This is what living paycheck to paycheck looks like.

| TOTAL INCOME (your paycheck) | DESCRIPTION | EXPENSES/ WKLY | = BALANCE |

| $500 | Health Insurance | $50.00 | $450.00 |

| Rent/Mortgage | $150.00 | $300.00 | |

| Utilities & Heat | $50.00 | $250.00 | |

| Auto Payment | 0 | ||

| Auto Insurance | $50.00 | $200.00 | |

| Fuel | $50.00 | $150.00 | |

| Phone | $50.00 | $100.00 | |

| Internet/Cable | $50.00 | $50.00 | |

| Groceries | $50.00 | 0 | |

Do you see anywhere in the above any place for savings? Nope. There you have it. What it means living paycheck to paycheck. When you budget for only your monthly expenses and not for your future or for emergencies or even ‘fun’.

O.K. now go back to that blank three column sheet you created a few minutes ago and fill in off the top of your head what your income and expenses are. Don’t worry you can go back and fix with the real nitty gritty later.

YES! You Can Break The Vicious Cycle Of Living Paycheck To

Paycheck

Yes, you can. You can break this cycle and if you started doing the 3 columns, you’ve already started. In order to get this new mindset you have to ‘do the math’, the plus and minus of it all. We’ll get to the apps and spreadsheets later. You need to ‘write it down’ today. Please.

So, by now you probably have figured out it’s less stress and certainly liberating to acknowledge you wan to stop living paycheck to paycheck with no savings for unexpected expenses. We’ve covered ‘what is’ living paycheck to paycheck, so you know if this is you or danged close to you.

Now, I’m telling you, YES it’s possible to learn how to not live paycheck to paycheck! By writing the three columns we mentioned you’ve begun. Yes. that’s where we start to evaluate our paycheck to paycheck budget.

But Are You WILLING To Stop Living Paycheck To Paycheck?

My money’s on you. Don’t worry if you fall. We’re here to pick you back up. I’m not going to sit here and wave a magic wand, this stuff takes work and well, for some of us, tears. You’ve all heard the saying about nothing good in life comes easy. Trust me, we’ve tried the other way.

We know by now that we need to stop living paycheck to paycheck. It’s not rocket science, it’s simple math and yes, calculators allowed! Part of the biggest adjustment is going to be accountable to yourself.

Sacrificing some take out meals or buying a round of drinks for friends isn’t going to kill you. Giving up that mani/pedi may be a bit of a sad moment. You’re surviving a pandemic you can do this!

Remember “No pain, no gain” The amount of time getting right side up will depend on you. How much debt you have, how many cuts you are willing to make. It also depends on how much debt you’re faced with. So, let’s dig in before we let that beast eat anymore of our money.

Are you ready to start a ‘paycheck to paycheck’ budget?

Easier Said, Hardly Done: No-Nonsense Steps to Stop Living Paycheck to Paycheck

Let’s face it, it’s easy enough for me to tell you you need to start at the start line. However, most people like to start at the finish line and have it ‘done for them’ approach. The days of instant gratification are over (did they ever REALLY exist?)

So, Tell Yourself:

- What is your Monthly Income? (after tax)

- What regular bills do you pay? Break this into 52 weeks.

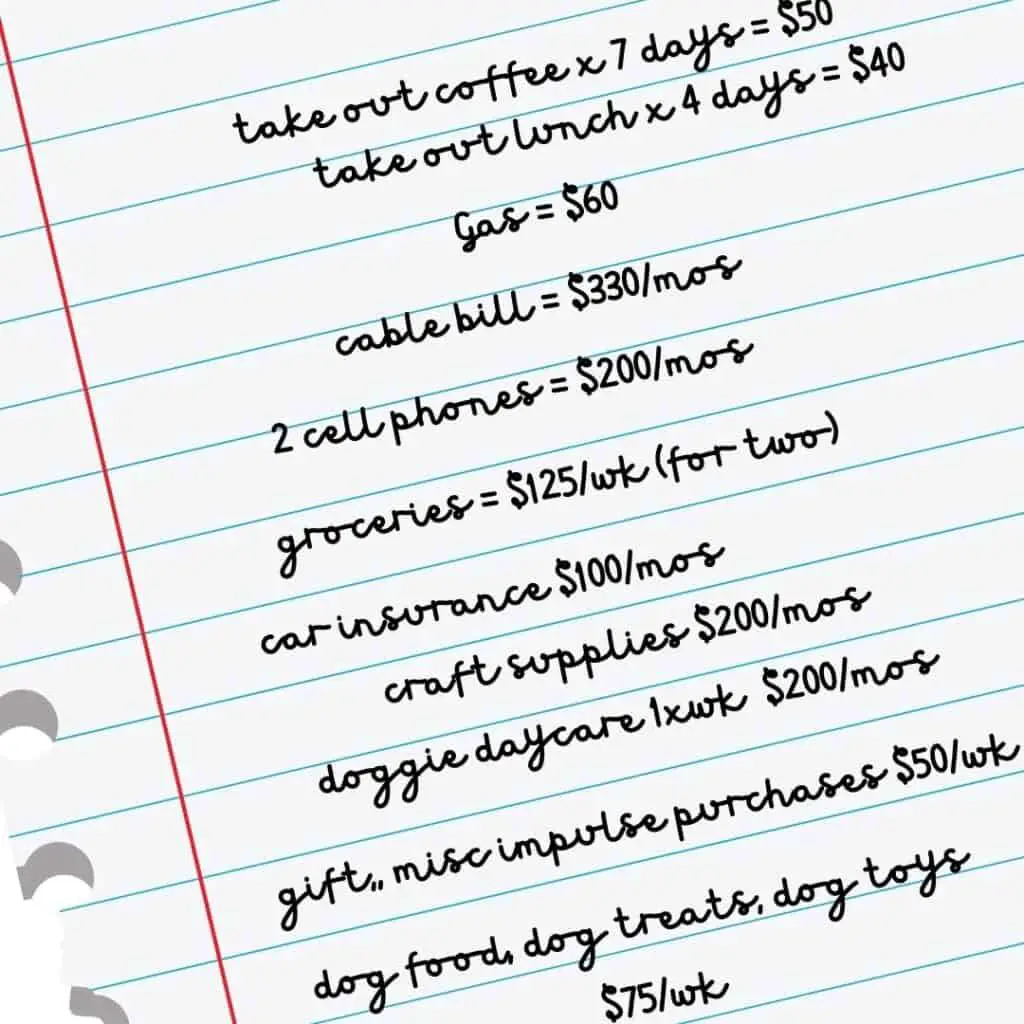

- What are your daily habits? Coffee? Take out meal(s)? Smoke? Drink?

- Don’t forget the kids activities

- Remember the Pets

Put these in your three columns

| TOTAL INCOME | – | TOTAL SPEND/OUTGOING | = DIFFERENCE |

There you have it, the very beginning of your ‘hardly ever done’ living paycheck to paycheck budget.

1. “Free Your Mind And The Rest Will Follow”

Now follow along with this part or don’t and call me crazy. O.K. I’ll admit it, I had no idea what this was and why on earth people thought it would work. In a moment of complete overwhelm in my life, I tried. it works. Oh, I’m talking about a BRAIN DUMP. No jokes, ok?

Financial stress is a leader on the causes of stress in the U.S. Last I checked it was the second highest. These recent years with politics and pandemic I can’t imagine anything has changed much. Probably worse.

In order to move forward on this journey to living paycheck to paycheck freedom, we’re going to start with a ‘fresh mind’

Budget Blocks Be Gone

Get that Pen and Paper again! Here we go. Regardless of if this is about money or not, you’re going to write it down. ANYTHING AND EVERYTHING ON YOUR MIND … IN YOUR BRAIN.. Today, here and now.. if it’s floating around up there, invading your sleep, your thoughts, write it down. Good, Bad, Ugly, Beautiful and Memorable. Write it down. don’t be neat either if you don’t want to.

I did mine on a 5×7 piece of paper and ended up scribbling in margins and even onto back of paper. I’m a classic overanalyzer!

Don’t re-read it, if you wrote it twice that’s o.k. too. Don’t analyze it, read it, ponder it or think about it. Write it. When you’re done, take a break, walk away. If nothing else comes into your head to write down during your break time, you’re done with the first half.

Now, take that (brain dump) list, scrunch it up like a dirty tissue YUK.. open it back up without reading. Now tear into a million little pieces or burn (safely). Flush, Trash, Shred or put in a compost pile.

Done. That’s it, you’re done. Tell me in comments below tomorrow if you slept better. I know I do and it works for months. Now when I catch my thoughts keeping me up or worse, waking me up I go through the process again. It works!!

Your Money Mindset Will Keep You Grounded In Life and Your Paycheck to Paycheck Budget

NOW.. take another clean sheet of paper (preferably next day, after a good night’s sleep). Write down a positive affirmation, note, quote, saying. Some words that you can now ‘refill your soul’ with. Post it where you’ll see it, make it a screensaver, and make another to keep in your wallet. Pick words that resonate, you can change them as often as you need.

‘Be Brave, Believe in YOU‘

2. Cut Until You Cry! Stop Spending Immediately

Get out the box of tissues or punching bag. This may hurt (just a little).

Tough times call for a tough look and tougher actions.

For Starters, I’d strongly suggest an immediate non-essentials spending freeze until you’ve got a hard copy budget to work off of. This could take a day or two. Clear off the table and make a date with your bank statements, your bills, and your paystubs!

In order to stop living paycheck to paycheck there’s no way around it, you have to make some cuts. Going cold turkey for a day or two whle you get a plan in place is going to pay you back in more sleep and money! This is how we start to not live paycheck to paycheck going forward.

Must Read: Take The No Spend Challenge & See Budget Results Immediately. <<< click to read

3. Give Yourself a Dose of Reality: List ALL your Monthly Fixed Expense

(Mortgage, Transportation and Insurances, Utilities,…etc)

In order to really stop living paycheck to paycheck, you’ve got to do the work. This part is hard for some, but once it’s done, you’ll feel almost a physical sense of relief. There is power in knowledge and this is where it begins.

I’m a crime tv buff. When they’re searching for a big crime ring, one of the consistent ways they find the criminal is ‘follow the money’ Well, here we are at the scene of your financial crime(s) and we’re about to follow the money and find where the big ‘offenders’ are in your budget (no, not a person but things like excessive take out orders, delivery fees, subscriptions, etc..)

Gather your bank and credit card statements and empty those pockets and purses of receipts. Let’s find the ‘evidence’. Write down everything. Every Single Thing You Spent Money On.

The firt time I did this I used my bank statement. Where there were cash withdrawals I ‘guessed’ at what I spent cash on. Debit card transactions and paypal transactions were all given my best attempt.

If we want to truly understand what is living paycheck to paycheck, we have to see how much of that paycheck we’re spending on ‘impulse’ and ‘excess’ expenses.

Learning how to not live paycheck to paycheck starts with know where you’ve been, knowing where you are and then you can start to see where you’re wanting to go with your money.

A paycheck to paycheck budget will start to be more clear once you write all your ‘truthful’ expenses down.

O.K. You’ve written everything down. Now take a break for a few minutes. Cry, laugh or get a coffee (home made please) You’ve earned it.

When I first did this it was emotional for me to realize how much I had contributed to my own self failure. I felt very vulnerable and inadequate. I’m not. I’m strong, smart, independent. I just let life get me off track and well, NO MORE. I am in control and deserve to have good things when I’ve earned and worked hard for them. No Longer will debt own me.

4. Give Yourself A Shock: List All Of Your “I’d Die Without My Netflix”

For real do you think you’d ‘die without’ Netflix? Maybe without your health insurance but I think your Netflix addiction will survive if you find you have to ‘do without’. If you are serious about not living paycheck to paycheck no savings, then we’ve got to take a real look at where you’re money is going.

Make a list of What you ‘Need’ to pay.

- Rent/ Mortgage

- Utilities

- Groceries

- Health Insurance

- Car Insurance, Home Insurance

- Gas

- Child’s school expenses

- Loans

- Other

Now make a list of items that make your life ‘livable’

- Cable TV

- Internet

- Smartphone

- Amazon Prime

- Other

These will become part of your new plan to end the paycheck to paycheck budget trap. Are you starting to see places you need to cut in order to stop living paycheck to paycheck? I think you are. You’re smart and if you’ve followed along this far, you’re committed. You’ve got this!

Let’s keep going and continue on this journey of How Not To Live Paycheck to Paycheck. Remember, you can do this! Actually, you are doing this!

5. Add Up Your Income Streams, Compare Step 3 & 4 With Step 5

Income means just that ‘in coming’. In this section, it’s simple.

Add it up! Your income and if you have a contributing partner with your budget, add all their ‘incoming’ money as well.

| TOTAL INCOME (SECTION 5) | TOTAL ACTUAL SPEND (SECTION 3) | TOTAL DESIRED EXPENSES (SECTION 4) |

I’m placing bets you just saw it, saw why you’re living paycheck to paycheck no savings to be found in the ways your spending today. In order to stop living paycheck to paycheck and find our new paycheck to paycheck budget, we need to get the above three columns in order. I know, I just said the obvious, but saying it and doing it are two things you need to get used to. We have to speak the truth to ourselves if not anyone else.

6. Create A Livable, But Not Necessarily Lovable Budget

So, what I’m asking you to do here is create a ‘must’ pay, ‘need’ to pay. The biggest difference in how you’re doing things now is I want you to take a good look at making a 10-20% cut across the board on non-fixed expenses (rent/insurance, etc..).

We all remember your mom or dad saying ‘we aren’t heating the neighborhood’ Well, lock it down. Living paycheck to paycheck with no savings often means you’re tossing money out in the trash. That’s right. You’re throwing money away.

So, you want to start saving towards your ’emergency fund’ at this point. First you need to find the money to do that.

Let’s start simple.

First and MOST IMPORTANT: Pick a number $5 for example. Open a savings account, set up a direct deposit or automatic debit to deposit to that savings account once a week.

You know what it is living paycheck to paycheck, so let’s try stretching a bit here.

Cut Avg Grocery bill by 10% How? Use coupons, drop the brand names, make your own cookies, plan your meals around the sales. Buy1 Get 1 when you can. Shop ‘day old’ displays and dinged and dented veggies and fruits. This was one of my first expenses scrutinized when I was learning how to not live paycheck to paycheck.

When you can stock up on in-season super low-priced veggies, buy and freeze or try canning. We grow a large majority of our year’s vegetables right in our back yard and all our seasonal lettuce right out the door in containers. All for the price of a few used pots and a packet of seeds. Savings per month approx $100 year-round.

Decrease your Electric Bill. Pick up the Phone and Schedule that FREE Energy Audit most electric companies offer!!! Those Beautiful Smart TVs, Smart Phones, Coffee Pots, etc.. UNPLUG. They are drawing electricity even when not in use. Savings vary seasonally for us. We heat on a wood pellet stove but we save on oil. I keep shades down to keep cool air in over the summer months and up for free light and sunshine in the winter months.

CABLE TV. Oh My, Highway Robbery! I am horrified at the price increases I’ve seen recently. I’ve just cut all but my ‘basic’ cable and increased my wifi for streaming much much less expensive options. We will be subscribing to ‘competitive’ offers then unsubscribing and trying new ones two or three times a year. These simple changes saved me over $100 a month!! I know others that saved even more by making these changes.

Smart Phones do not always equal smart shoppers. My husband is a flip phone user. Yup. Well, we know, simple right? Flip phones cost less. However, when I was shopping for a new phone for him I was outraged at the price of just the phone. This brought me to look into what we would have considered ‘low budget’ providers. Guess what? ZERO difference in service but a HUGE difference in the bill. One provider wanted $200 for a new flip phone and a low price of $60 a month for service. He uses his phone a lot for work, so we wanted unlimited service.

We ended up shopping around for hmmm all of an hour via google and our bill is now (not a contract newbie price either) $30 month and I paid ‘in full’ for a brand new phone of $50. Savings $30 a month. Now to attack my smartphone plan next. I anticipate saving about $50 a month. You can look into pre-paid services too, I hear Walmart has an awesome price point for these!

O.K. you get the idea. Go line by line of your present paycheck to paycheck budget and start cutting by a minimum of 10% on each line.

Pay yourself first. Start low, add more as your budget improves. Keep it simple. Keep it realistic, but real. Real Changes mean real benefits here.

7. In The Words Of Cuba Gooding, “Show Me The Money!”

Having ‘the talk’ with your family, children included is a big part of adulting. Yup, time to put on the grown hat. Get over the pride crushing reality of your budget exercises above. Time to make it a family sport.

Talk in an age appropriate way to your kids about how you are going to make some changes to better your future, strengthen your ability to have important things in life and reach for goals like buying your first home or going on that so deserved vacation.

Explain that things like the fast food take out is going to stop for a while and will be a ‘special’ treat. The brand name cereal box may look different now with the ‘store brand’ picture. ( true story: My mom used to put my dad’s store brand corn flakes in the brand name box!)

Have a family vote on what cable channels get the ax and which ones make the cut. Streaming makes changing channels out monthly easier now, so you can rotate and have less in the summer months when we tend to do more outdoors. Find flexibility that works for you. Keep in mind, that there NEEDS to be some real serious cuts so you get to pick the more frugal ‘choices’ for the vote.

Let the kids know what an emergency fund is vs discretionary spending Talk about having a family ‘yard sale’ to jump start the emergency fund. Start two savings accounts. Take one for the Emergency fund. Build this one more aggressively. Use unexpected savings (birthday money, rebates, sale of old bike) towards the discretionary fund.

Emergency Fund shold be 3-6 months of ‘essential’ living expenses. Think of if you lost your job, no unemployment what would you need to ‘get by, survive’.

Discretionary spending is typically looked at as 30%. While you’re getting caught up and making changes you should strive towards spending much much less than this. Still save but let’s get that emergency fund built up to a minimum of 3 months first. Try to explain this to your children in simpler terms depending on their age.

How to not live paycheck to paycheck needs to start with you, but you have the power to change your child’s path by teaching them these things now.

Starting with a paycheck to paycheck budget will lead to greater financial and family rewards down the road.

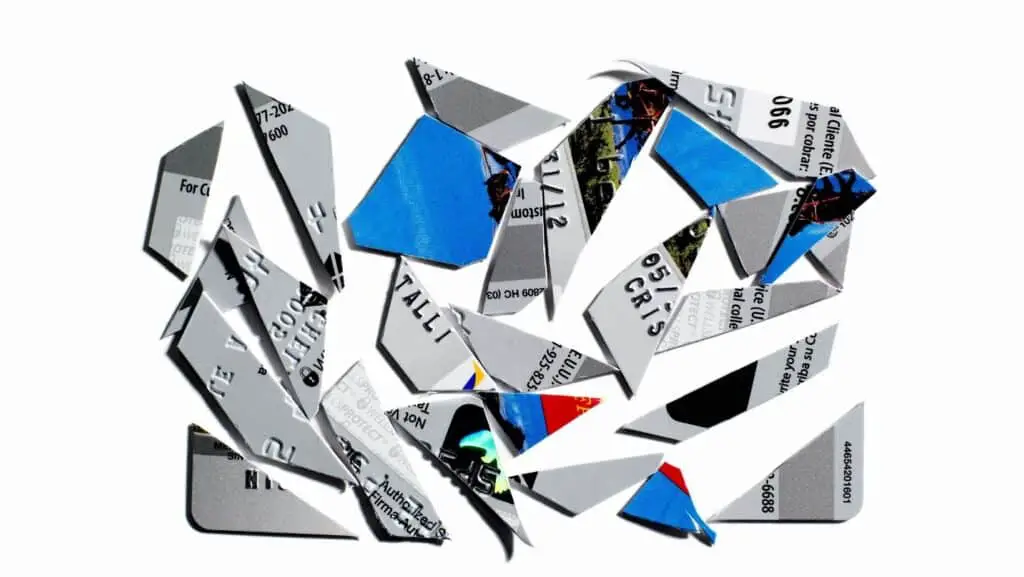

8. “Hey Credit Cards,” Hit the Deck! I Mean Drawer

Oh, I hear ya! Credit Cards are an honest addiction for many of us. They’re a ‘crutch’. In the past, I’d cut them up then call the card companies to send me a replacement a month or two later. I’d use them in the name of the ‘great deal’ I ‘had to have’. Do you think I can remember one single ‘had to have’ item? Of course not.

You know all the ‘pitches’ 0% introductory offer. No payments for 12 months. (store credit cards are brutal with their tempting offers). Buy now pay later. Earn double rewards, triple rewards. Yup, you’ve heard them all I’m sure. Yet, here we are and you and so many others in America are paying outrageous interest rates.

Living your financial truth is hard. Stop living paycheck to paycheck and lying to yourself with the aid of credit cards. Cut them up, call the card company, and shut them off. NOW. Keep one and only one for ‘true’ emergencies only. No, a birthday gift or pizza is not an emergency.

Warning: some companies will try to keep you with better rates, etc… nope, no way, no thank you.

9. Get a Job! Hey, what!? “Part Time Work From Home Position Available”

Well, here we are day one and you have all this free time without shopping !

Let’s start to de-clutter. Same three piles as the usual spring clean up.

| THINGS TO TOSS | THINGS TO KEEP | THINGS TO SELL |

Let’s get day one off to a good start and stop living paycheck to paycheck. Use your phone and start listing your ‘things to sell’ pictures on Facebook sell groups or eBay. Get kids involved and even have a ‘live’ yard sale. It’s a great way to spend the day together, meet new people, and what a team project to kickstart your savings.

Tip: Set up PayPal for payments at yard sales and ‘meet ups’ so people can buy easier and with protection from both sides. This also makes it easy to transfer money directly into your savings account without the temptation of spending ‘just a little’.

MUST READ: Non-Craft Items You Can Sell on Etsy ! <<< click here to read

10. Pay Yourself First, Every Paycheck, Every Week.

O.K. so you saved or made your first extra $5. THAT is a GREAT Step. Remember where you started.

Open a savings account and get that money in that savings account today. There are plenty of online banks where you can start your account(s) now. These can help eliminate the need to find a banking institution locally or that has hours you can be available.

By now you should have found places to cut even more. Be sure to put that directly into savings. Remember, it’s part of your new lifestyle and paycheck to paycheck budget. You now have started applying what you’ve been learning about how to not live paycheck to paycheck. YAY!!

Why Are So Many People Living Paycheck To Paycheck With No Savings?

I believe most of what got me into debt many years ago was the old ‘living up to the jones” lifestyle. i was a single mom back then living on an entry-level paycheck. I wanted to be able to dress, entertain and live the way my peers with no kids no expenses were.

For the most part, I did. It came with a price. Child support stopped, rent went up, gas prices skyrocketed and that low introductory credit card just kicked me right in my Irish arse.

Had I had and ‘stuck to’ a paycheck to paycheck budget in those earlier years I would have had much less stress and more to show for my hard work much earlier on in life. I took the hard road you don’t need to. Once I got my balance (emotional and financial) back, I was on my way to a much happier life. Financial choices are also about learning to love your financial truth and embrace the important things in life.

There are other factors of course. The loss of a job, inflation, medical emergencies, transportation issues. All of these and more play a big role in holding us down. The bottom line is the more prepared earlier on in life, the better we can handle these burdens. However, starting at any age is a huge relief for us. No time like the present, right?

“You Can’t Handle The Truth!” or Can You?

Let’s talk briefly about where bad habits can be triggered.

You had a bad day? Buy yourself an icecream or a new pair of shoes.

vs

You had a good Day! Buy yourself an icecream or a new pair of shoes.

Dumb, right? Well, Debt is Dumb and not always rational. You are Smart, Sensible, and a Saving Saint!

Listen, instant gratification is a thing of the past, it’s childish and not where your grownup self wants to be.

Budgets are the new ‘sexy’ , Living Your Financial Truth is where it’s at today.

Repeat, write it down, say it out loudy. “I am no longer living paycheck to paycheck”

“If Giving Starts At Home,” So Does Saving!”

A not so nice view of American Education At Its Best: Saving is a learned behavior

I went to a small high school with a closer to a 10:1 ratio. You can imagine we had a lot more individual attention than kids are afforded today. Homeschooling may be the closest comparison to what I benefited from. We had teachers that spent time with us showing us how to make a grocery list, a budget of how to pay for those, and what kinds of meals we could make with the leftovers. Now, that’s a real home ec class!

More importantly, we learned the basics of a checking account. How to write a check, record debits and credits (and what that meant!), and how to balance a checking account.

Tell me your 15 year old knows how to write a check and balance (reconcile) an account? Hmmm, not many hands I’m going to say. Take a minute, teach your child these things. Find youtube videos, show real-life examples. Talk about compounding interest and how it can help build your wealth or take you down at the knees.

Financial comprehension and literacy are at an all-time low. We can’t expect the schools to do it all. Money talk starts at home and it starts early. There are many free resources out there (including … remember this place ? Your public library!)

Savings and being educated about our financial truth and choices is a family sport, remember?

Words To Live By “If You Have To Ask, You Can’t Afford It” And “Cash Is King”

(Anything that isn’t essential to survival is not in the budget if you can’t pay cash-also if you don’t have an emergency fund yet, you can’t buy anything that isn’t essential)

While we’re in the early stages of our paycheck to paycheck budget, still adjusting to how not to live paycheck to paycheck (or payday to payday) it is so important to NOT spend on any ‘extras’ If you haven’t budgeted/planned for it.

If the money isn’t set aside then you just need to either do without or maybe put it on a list of items you’d like to save for in the future.

Your living paycheck to paycheck no savings lifestyle is not permanent if you commit to the process early on.

You’ve got this. I believe in you! YOU Believe in YOU!

This Too Shall Pass! If You Don’t Want To Live Paycheck To Paycheck, You Won’t

You will never win if you never begin.

~ Helen Rowland

The Absolute Best Step To Stop Living With Paycheck To Paycheck Stress Is…

If you said An Emergency Fund you’re right!

So, Let’s review quickly here.

- Living paycheck to paycheck or payday to payday is: When you pay all your expenses and have no money left until the next payday.

- How to not live paycheck to paycheck? Easy right. Create, stick to and live by a paycheck to paycheck budget.

- What is an emergency fund for? Urgent unplanned for true expenses, not a luxury or optional items. examples of these would be an unplanned medical emergency, loss of job, unplanned car repairs, family emergency travel expense.

- What is a good amount for Emergency Fund? The goal is to save 6 months of ‘expenses’ not luxury items. Start in Steps. Save one week, then one month, then 3 months, and so on. Once you’ve reached your 6-month emergency fund savings you should sit down and re-evaluate your expenses. If they have increased such as rent or insurance costs then adjust your emergency fund accordingly.

How Do YOU Spell Relief: E- M- E- R- G- E- N- C- Y- F- U- N- D

the ‘other’ benefits of having money to fall back on.

The number one benefit of an Emergency fund is being able to live with less stress. Stress leads to poor decisions, lack of perspective, negative health effects and can crush a strong relationship.

Two years ago our family experienced a medical emergency. My husband was in an induced coma for nearly 5 weeks, on a ventilator, and required months of respiratory and physical rehab after that.

Our emergency fund saved a lot of added stress to an already near devastating time in our lives.

Look, all I’m saying is ‘unexpected’ and ‘unplanned’ emergncies can be hard on so many levels. Do your best to reduce the outside stress with a well planned emergncy fund.

How NOT To Live Paycheck To Paycheck With No Savings. Final Tips:

What are your favorite tips? The Ones you are going to share with your kids and grandkids? Here’s my quick list:

- Have a paycheck to paycheck budget plan.

- Start your emergency fund today no matter how small, just start.

- Write it down, all your expenses, all your income.

- Live and Love your Financial Truth. Have an open relationship with your money.

- Break up with those old school habits like keeping up with the Jones’ and instant gratification.

- Take the No Spend Challenge to Kick Start your savings.

- Trash to Cash. Have a Yard Sale.

- Write everything down.

- Rinse and repeat.

- Re-evaluate often.

- Include the whole family.

- Make a vision board.

- Encourage one another always!!!

Visualize Your Future When You Are NOT Living Paycheck To Paycheck

Money mindset is a powerful tool. Believing in your journey and removing emotional blocks. One of my favorite and most successful money ‘hacks’ isn’t really a hack but a tool. I use vision boards as a visual tool to see my goals. Now some of these goals are crazy sounding to some but truth, they work.

Some of the larger things I’ve accomplished with my financial vision board are Early Part-Time Retirement (check), Paid cash for a brand new car (check), Finance second home (check).

What’s next? Finance third and fourth homes (there’s a plan and a ‘vision’) for income. Obtain more education (yup, as we speak). Work on a ‘financial’ planner and budgeting for beginners course (planning stages) and so much more!

My husband wants to add a new puppy to my vision board haha. I’m not ready yet. We have two senior dogs who I am enjoying every moment at this very moment.

If you hop on over to my Money Mindset tab I’m sure you’ll find some tips that fit your unique and individual needs too.

MORE ON MONEY MINDSET <<<< CLICK HERE

Go Back Over Your New Paycheck to Paycheck Budget And Cut Some More

You may already be seeing results but don’t stop there. To really stop living paycheck to paycheck you want to re-evaluate. challenge yourself to make more cuts to your paycheck to paycheck budget.

Keep a notebook nearby to track expenses, regularly review receipts and grocery sales, gas prices. I find it super exciting when I find my ‘deal of the year’ on toilet bowl cleaner and get to stock up for a year’s worth!

You’ve learned how to not live paycheck to paycheck, now let’s kick it up a notch and find some more places you can even earn some extra cash?

Pay Yourself (aka your savings) The Absolute Most You Can Get By With to Get your EF fully funded.

Let’s go one more level if you haven’t already. Do some price comparison on frequently purchased household toiletries and groceries. I find that ordering from Walmart every few months saves me time and money. Free shipping on orders over $35 means I can order items like my toilet paper, dish detergent, bathroom, and household cleaners, and some canned goods that are much less than the nearby grocery stores. I am sure to check though, these items go on sale at Target too, and sometimes I can find a better deal there.

Look for a Temporary Income Stream to Fund You Or Expense Reductions

There are many ways to add a few cents here and there to your savings. Sign up for savings apps like Ibotta that refund you money when you purchase certain items. This past thanksgiving people got entire Thanksgiving meals for FREE. No kidding!

I shop online frequently for office supplies and am sure I sign up for the store rewards programs. In addition to the rewards, I also get cash back on most of my purchases through Rakuten.

I’ll share my referral link for you too. According to the offer today they are paying YOU $25 for the first $25 your spend and me $25 for your account being activated. WAIT! Once you are active you get to refer friends too! How’s that for FREE Money ‘plus’ cash back on purchases. (bonus: they offer double cash back days, free gift listings, and in store rewards)

Places like Swagbucks will pay you for watching videos and printing and using coupons, daily bonus points, and you guessed it ‘just for signing up’ and ‘referring freinds. EASY.

Ask your savings institution if they offer ‘rewards’ for referrals. My credit union does and I get $25 for each active savings account sign up after a certain amount of days. By the way, they deposit my referral bonus directly into my savings account!

I have a friend that has a sewing course. Her students (even non-students) earn an affiliate commission for referring once person signs up.

Once you start to ‘look’ for these things they are there for your benefit as well as theirs. Stuff like this is zero cost to you, no additional cost to the person who is purchasing. Affiliate payments/ commissions are a way of the seller saying thank you for referring and believing in their product/service.

Tell me the last time you walked into a store and they said here’s $10 for bringing a friend shopping with you today. Said no one ever!

Do you or someone in your budgeting household have a large social media following (eg; Instagram, Twitter, Tiktok) Brands and even social justice programs are always looking for more social media presence and they pay very well!! Apply here and start sharing programs, then when applications for campaign opportunities become available you’ll already be familiar with the companies mission and values.

Start looking around, there are gas rewards places. Call, ask or look when you are fueling up. For the best prices nearby I like using GasBuddy.

The savings are there, the income is there, you need to just be open to a new way of seeing things. Start creatively building your savings and stop living paycheck to paycheck while you are doing things you already do!

Set Up a Fun activity (preferably Free) To Celebrate You Weekly Success

Pat yourself on the back. Give yourself and your family something to look forward to. even if it’s baking cookies decorated as coins. Plan a scavenger hunt for your kids or just adults? Pack a lunch (and those homemade cookies) and make an afternoon or a day of it. Be sure to acknowledge the ‘special occasional’ as a celebration of success! Lousy weather? Play a board game and the winner gets to have all the players make a statement about what is so great about them.

Be sure to see the great things that are coming from this new lifestyle. Living paycheck to paycheck is now a ‘thriving paycheck to paycheck time.

I’m beaming here with how far you’ve come and so truly happy you are seeing better days in your future. It only gets better from here.

What you do today can improve all your tomorrows.” Ralph Marston