*This post may contain affiliate links. As an Amazon Associate we earn from qualifying purchases.

What To Do If You Get Laid Off & How To Survive Financially

It’s never easy to find out that you’ve been laid off from your job. It can feel like the end of the world and it is often difficult not to panic. Today we’ll talk about how to survive a layoff financially. The first thing you need to do is take a deep breath because this really isn’t going to be as bad as it seems right now. You’re still alive, you have food in the fridge and a roof over your head so there really are many things worse than getting laid off from work!

There have been so many recent layoffs in the past year. It’s not something anyone wants to hear. Losing a job can be devastating and frustrating.

This article will walk you through what to do if you get laid off and how to survive a layoff financially. Some of what we’re going to chat about are:

- What information and paperwork to ask for

- What does this mean for you?

- Furlough vs Lay-Off

- Healthcare information

- Benefits to inquire about

- Budgeting and adjustments to make to your finances

- and more about how to survive a layoff financially

In today’s economy, it is becoming more difficult to find a job. The unemployment rate for people in the workforce is currently 6%. This means that 60 of every 1,000 workers are unemployed and looking for work. Scary I know, but we’ll get you feeling a bit more secure with your future plans.

What Does It Mean To Be Laid Off?

I find that understanding the ‘terms’ can often help better understand the situation we’re in. A layoff is not intended to be getting ‘fired’. Being fired from a job is for reasons that are clearly laid out as unacceptable by the company you are working for. A layoff is quite different and usually part of an economic change in business.

A layoff is a termination of an employee from their job. It may be voluntary or involuntary, but it typically occurs when there is no work to do.

A layoff can happen for several reasons: the company might have financial trouble and needs to cut costs; they might need fewer employees because business has slowed down. They may want to move in a different direction with the business, which requires changes in staffing.

You may have a lot on your mind right now, and believe it or not, your company is also trying to figure out surviving a layoff also. Loss in staff means asking remaining workers to do more with no additional resources or pay.

What Are You Entitled To If You Get Laid Off?

One of the first instincts we have is how to survive a layoff financially and what to do if you get laid off. We have a strong urge to be in control of more in our lives. This includes knowing what we are entitled to and eligible for. We’ll cover these points starting here.

Oftentimes, people feel entitled to a severance package when they’re laid off, but this is not always the case. In some cases, employees can be required to sign an agreement when they start their position that states there will be no severance pay if they lose their job. A company might do this to protect itself from being liable for any anticipated costs in the event of a layoff.

There are also several state and federal laws that provide protection for workers during layoffs and terminations. These protections don’t apply to everyone. They only apply in very specific circumstances or situations.

The best thing you can do is find out what your employer’s policy on termination, layoffs, and associated benefits is before starting work with them so you know what to expect should this happen to you. You can also request a copy of all current policies in the event you need clarification. It is never bad to get anything in writing/ black and white.

- Get a Human Resource Contact Name and Number

- When will you receive your earned paycheck? Any Vacation Pay Due? Are you entitled to any unpaid sick time? (many states require this to be paid at time of being laid off)

- How long will your benefits be extended (health insurance, other)

- Will the company be offering you any employment resources for assistnce finding a new job

How Do I Find Out If I Am Eligible For Unemployment Benefits?

Surviving a layoff means not only knowing what your benefits and rights are but how and where to go for financial and employment resources.

What Are Unemployment Benefits?

Unemployment benefits are insurance payments made by state governments to employees who have lost their jobs. These payments replace a portion of the employee’s wages they would have earned if still employed, can be received for up to 26 weeks in most states.

You can anticipate approximately 50% of your net pay to be covered by unemployment insurance if you are found to be eligible.

In order to receive these benefits, you must meet certain eligibility requirements by your state and federal government.

While this is going to be most likely you main income for a little while, this is not the only way to surviving a layoff financially. We have more tips and information below.

How Do I Check To See If I Am Eligible for Unemployment Benefits?

You should contact your local unemployment insurance agency. If you do not know that number, you can look it up at Benefits.gov by typing in your state’s name. Do this as soon as possible as it can take 2-4 weeks for your benefits to be determined.

Be sure to have your lay off paperwork with you when you make call, go online or go in for application. You will need to know your recent work history, your date of last employed, employer name as stated on paycheck, your identification.

Check first to be sure you have a complete checklist of what your state requires so you can make the best use of this time.

Keep in mind, unemployment assistance can also include asking for job search assistance, resume assistance, and possible eligibility for training.

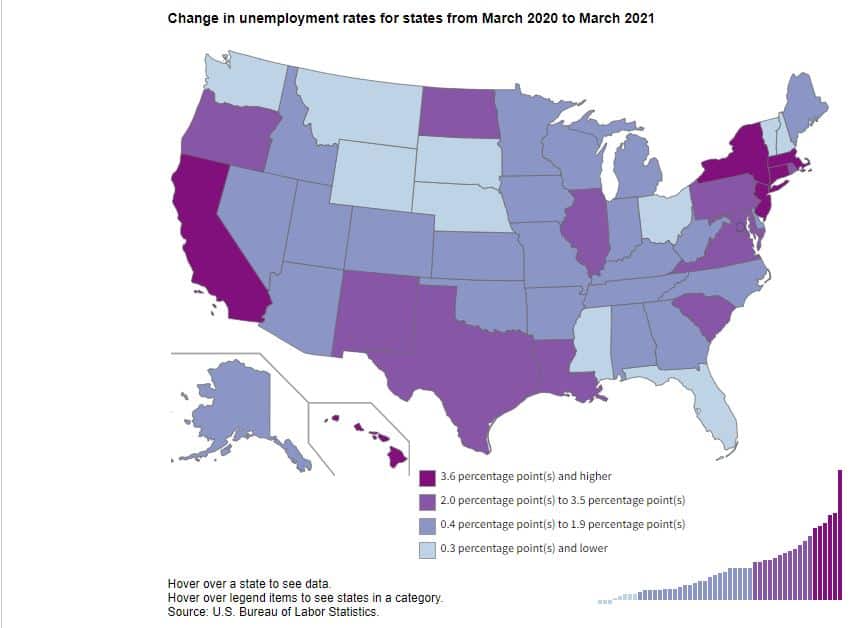

source: Bureau of Labor Statistics.

Is A Furlough The Same Thing As Being Laid Off?

If an employer intends to recall employees from being on the furloughs then they typically have intentions of bringing them back as soon as possible. A furlough is more of a temporary situation and has a range of expectations of when you will return to work.

The difference between a layoff and a furlough is that if you are laid off, it usually means your job will not come back at any point.

What Is A Furlough?

A furlough is a temporary layoff. Furloughs usually last for one to three months, and they can happen at any time of the year.

A furlough means that you’re not being paid during this period, but your employer might offer you some benefits such as health insurance or not dispute your claim to unemployment pay.

Follow the same advice above and go to Benefits.gov to see if you are eligible for any unemployment insurance during your furlough.

Surviving a furlough can be a lot easier if you know exactly when your return to work date is. You’ll have a much better idea of what to cut from your budget to get by.

Can You Be Laid Off While On Furlough?

The short answer is yes. You can be laid off while on furlough. Employers may have determined that the furlough period was just not as economical as they’d hoped and find themselves needing to make more permanent layoffs.

What To Do If You Get Laid Off After A Furlough?

You will want to return to your list of questions to ask your employer. Find out about your health insurance, final paycheck, any benefits that may be extended, and which ones will be terminated effective immediately.

There is a good chance this time around your layoff will occur over the phone. You will have more time to feel composed and organized. Make your list of questions and request documentation be both mailed and emailed to you. Make a note on your calendar to follow up. If you have not received this information you may need to request again. Also, you will want to update your unemployment status immediately.

How To (Professionally) Handle Being Laid Off At Work

Being laid off can feel very personal and a lot of emotions can arise from being caught off guard. Remember, this is not about you. This is about the company and its financial outlook.

Keep it Professional not Personal Please. Maybe the shock factor will keep you from being emotional, but if ever there was a time in your working life to be professional, calm cool and collected, its now.

There’s a good chance the person telling you about your layoff is only doing their job and full well knowing this could be their job next. They are the company messenger, doing the not very fun side of their job. Remember to thank them before you leave.

Ask Questions:

- May I have your name and contact information? (email, phone) If not, who may I contact for any questions or information I may need.

- When is my last paycheck? Does it include my unused vacation time? unused sick time?

- Will my benefits continue? If so, for how long?

- Are there any opportunities I am eligible to apply for? (meaning any other jobs?)

- May I re-apply in the future for another position?

- Are there any resources suggested or information they feel would be helpful?

Keep Focused And Stay In The Moment While Being Laid Off

(a lot of important information will be discussed)

Keep Your Wits About You. A lot of information will be discussed. Get a pen and paper and start taking notes as if it was a meeting.

Remember those pop quizzes in school? Caught you off guard and while you may have wanted to hide in the bathroom, you took a deep breath and got through it just fine. You’ve got this.

Get names, numbers, and as many details as you can. As long as you have contact information you can go back and ask more later.

Do Not Plead For Your Job or Be Overly Emotional

It’s an awful blow to the ego when you get laid off. You see others being left behind that have become like family or worse that you know you did a better job than them. They may be more emotional then you right now. Don’t let that get the best of you. You can be in touch with them in a few days and all get together for those hugs and group emotional support.

Keep it together, take notes, ask questions, be polite, collect your personal belongings and leave with grace, dignity and your head held high.

Lay-off decisions have been in the works for a while, usually irreversible. However, employment opportunities may still be an option today or in the future. How you chose to handle your layoff professionally can determine your future re-hire chances greatly.

Be Professional Throughout The Lay-off And With Any Further Company Contact

Deflecting can be a response from some, this is not the time to show your dark side. Placing blame or trying to point out another’s flaws is not going to change things. It could be seen as a negative trait and not play well for any possible future opportunities.

Layoffs are almost always pre-determined and rarely on a personal basis. They are almost always based on financial goals your company is falling short of. They need to make budget cuts just like you’ve had to do in your personal life.

Your goal in this moment of surviving a layoff is to leave the best impression behind and going forward possible.

This means not ranting on social media about the company or any persons you have worked with. People talk and if you are seen as a ‘trouble maker’ or a ‘gossip’ your chances of getting re-hired or a better reference will drop drastically.

Request Official Company Document Stating You Were Laid Off, Not Fired

I know we’ve already mentioned getting documentation, so let’s talk about why it’s so important. You honestly do not know the financial state of your company and if they will need to lay more people off, including your contact person!

You will also need written documentation for applying for benefits of any kind, such as health insurance or food relief as well as uninsurance benefits.

As part of surviving a layoff is being sure you have covered your own future the best as possible. This includes any unanticipated needs you may have. Having these documents will be an important part of this process.

Find Out How Your Lay-off Will Be Represented By The Company

Many companies have strict policies about what can be said once an employee is laid off or even fired. You should expect that your company handles your layoff professionally. This means your management and human resources persons.

If the person laying you off has not already told you how this will be handled, ask them. “Will you tell me what might be said when someone asks about my separation from the company? I’d like to make sure this will not affect my chances for another position.”

Surviving a layoff is all about protecting your future.

What to Do If You Get Laid Off (No Longer an employee)

I know. This is a lot. You have just been dealt a blow. Most likely you had no idea this was coming. Breathe, take notes, breathe some more. Remember, the more informed and educated on this process, the better we’ll know how to handle being laid off from work and surviving a layoff process.

Confirm HR Has All Your Current Contact Info

Depending on how long you’ve worked at this job, you may have changed your address and phone number once or twice over the years. Your manager may have the current info, but never assume that Human Resources has it.

Give your current contact info to human resouces it to them again to be sure it’s on file.

Get Your Final Paycheck (Or Find Out When You Will Receive It)

So many have their paychecks direct deposited. When you are inquiring about your final paycheck you want to know

- When should I expect my final paycheck (write the date down)?

- Will this be mailed or direct deposit?

Obtain Your Formal Release From Employment Letter

- Be sure to have everything handed to you at time of layoff if in person.

- If you happen to be laid off over the phone, request this to be mailed AND emailed to you.

- Take notes and follow up if not received within 1 week or less.

Inquire About Your Health Insurance Benefits/COBRA

Surviving a layoff financially can be devastating for some families without health insurance. One medical emergency can wipe out your savings and put your financial future on shaky ground. While this may not be a good time to think about what added expenses you may be looking at, you must do.

You want to be sure you are very clear on what your employer will be providing for health insurance benefits going forward. Some may extend full coverage through the end of the month, or longer. Let’s face the truth now though. If you are being laid off, your company already has financial concerns and won’t be seeing health coverage for too long.

If you are presently receiving health insurance through your employer you are legally entitled to receive information regarding COBRA to opt into extending your insurance. This may be administered by an outside company and you will receive it by mail. Again, be sure human resources has your current contact information/ mailing address included.

What Is COBRA?

The American Recovery and Reinvestment Act of 2009 contains the Consolidated Omnibus Budget Reconciliation Act (COBRA) premium assistance provisions that make COBRA more accessible for individuals who are now eligible to pay only 35% of their COBRA premiums. This is an excellent opportunity for people like you, as it helps with long-term finances in this tough economy.

- Ask if your health insurance benefits are being extended?

- Find out when you can expect to receive information on COBRA?

- Compare insurance prices against your spouse (if applies) and

- Check HealthCare.gov for rates. You may find are more affordable than COBRA.

Find Out If You Are Eligible For A Severance Package

First, ask if you are eligible for a severance package. A large majority of people are not eligible for a severance package.

If you are fortunate to have a severance package offered to you, you will want to review in detail how this will work.

- Will you receive a lump sum payout?

- Will you continue to receive a weekly paycheck?

- Does this include benefits?

- How does this impact your unemployment insurance eligibility?

Review And Rollover Your 401k Or 401b (Or Pension) Plan If You Can

If you have a retirement plan with your employer, you will want to review your funds and manage this money. Get this in writing.

Many retirement plans will allow you to stay on with that financial institution and roll into a non-contribution matching account. You may want to roll over into a personal plan you already have.

Be sure to have the documentation on this retirement plan and consult with a financial planner or your bank will have free resources to assist you as well.

File For Unemployment Insurance

No time to waste. You really want to put into action the benefits you have worked for and are entitled to. Time to pick up the phone or go online and file for your unemployment insurance benefits.

Unemployment is a federal benefit administered by your state. For most states here is what you’ll need:

- Names of all employers, address, phone numbers, possibly emails, and contact names

- Reasons for leaving those jobs

- Work start dates and end dates

- Do you have a recall date? (some seasonal layoffs do)

- Your bank name, routing, and account number for direct deposit (if you are not able to receive monies via direct deposit most states will send you a debit card with instructions)

You may need additional information under these situations:

- If you are not a U.S. citizen, your Alien Registration number

- If you have children, birth dates and Social Security numbers

- If you’re in a union, your union name and local union number, contact info.

- If you were in the military — your DD-214 Member 4 form.

- If you worked for the federal government — your SF8 form (optional)

When and How Will I know About My Eligibility

The best way to apply is online. You will have 24×7 access to your information to update, check status’. If you do choose to apply on phone, be prepared for wait times.

Your unemployment insurance claim status can be accessed online, via US mail, and by calling. Again, if you are able, be sure to sign up online for continuous updates.

Once You Are Eligible For Unemployment Insurance Benefits

- You will need to claim benefits weekly

- You will need to report your job search activities or

- Get approved for training opportunities approved by your unemployment department.

- Report any income weekly

- Respond promptly to any additional information requested.

Note: Check with your unemployment office. Many allow you to make a certain percentage before it impacts or terminates your benefits. Remember, the goal is to get you back working and financially intact in the meantime.

Get Your Resume Out Day One!

If you truly want to survive a layoff financially, you have a new job and you guessed it, it’s looking for a new job. First things first.

If you have an old resume and it’s not updated, dust it off. Update it. You can go online to places like:

- Indeed.com,

- Monster.com and

- ZipRecruiter.com.

Even your state will have resources for not only job searches but resume writing as well. Not a typer, no problem, you can go to fiverr.com and hire someone to do this for you.

A good tip for starting a resume is to find a few job descriptions similar to what you have done, use those keywords to help you get seen better.

Rather than trying to squeeze a wide variety of skills into one resume, consider having two or more resumes. For example; one for all that retail experience you’ve gained in your current or part-time jobs. A separate resume for your office skills and a third for any other skills you’ve gained in side-hustles over the years.

Multiple resumes focused on the skills you have that match certain job types are more likely to get noticed than the resume that shows Office Manager and Dog Walker.

Network With Business Associates And Update Linkedin

One of the best ways to find a job and how to survive a layoff financially also has emotional benefits. Networking. Network with previous employers, friends, previous co-workers, and business associates. Reaching out by phone call is more personal and makes a bigger impression on the person you are enlisting in your networking circle. I’d suggest following up with an email as well if the relationship is purely professional from your past such as an old boss. However, first a phone call!

One way of asking a friend of co-worker to help you with your job search is to ask for any feedback they have on your resume. So, yes it’s important to get that resume ready.

This is a not only great way to not get in a rut. Keeping in touch with others is important, especially on the days you don’t want to.

Update your Linkedin or better yet, create one if you haven’t yet!

How To Survive A Layoff Financially: Tips For Avoiding Debt Problems

- Review your present budget

- Do NOT touch your savings yet

- Cut all expenses that are not necessities

- Stop Auto-payments and auto transfers (check PayPal too)

- Contact all credit, loan, and service providers

- Postpone any vacations or retreats that are not pre-paid (if pre-paid check refund policy)

- Stop any ‘over-payments

How to handle finances being laid off work is a whole new lifestyle. You need to be very methodical and not personal when making these changes and cuts. The sooner you do this, the longer you’ll survive your layoff period.

A huge plus is you’ll also bounce back from this layoff and quite likely stronger with the new lifestyle changes.

Great Read: No Spend Challenge to Boost Your Savings; Cut Spending Habits.

Analyze Your Budget, Relentlessly Cut Every Non-Essential

You’ve heard it all before most likely. You need to use a very critical discriminating eye when you’re going through this step. While you may still be feeling a bit hurt about your recent layoff, you may also start to relate to your management about now. Giving up workers meant getting the same or even more done with fewer resources. Now it’s your turn to put on your boss hat and make some cuts if you are going to learn how to survive a layoff financially.

Best way to do this is to look at your bank statement(s) or receipts.

First write down all your necessities (for example):

- Shelter (rent or mortgage)

- Food (your grocery bill)

- Utilities (electric, gas, oil, propane for heating/cooling/hot water)

- Medical (insurance costs, prescriptions, other ‘health necessities’ ummm, not a gym membership)

- Clothing (necessities not a new pair of kicks to be on trend)

- Other: these may be transportation/car payment, insurance/ home insurance

Add that up.

Now write down all other expenses you’ve incurred in the past 30-90 days or annual fees, etc..

Contact Your Loan, Mortgage, Credit Providers Immediately

Get your list of all credit providers (loans, mortgages, credit cards)

Ask each one what qualifies as eligible for hardship deferment, forbearance or interest/fee reduction.

This may mean freezing credit cards, which is o.k. Keep one credit card open for emergencies.

Confirm what your minimum payments need to be to remain in good standing. These are the new amounts you will be paying while surviving a layoff.

Talk To service Providers To Reduce Rates or (Temporarily) Cancel Services

You’ve been complaining for months about the cost of your 500000 cable channels and your insanely expensive cell phone plan. Now is your motivation to get those services in order.

Go to your list of expenses, pull out or online the detailed bills of your service and review them. The obvious are your cable and subscription TV channels as well as your phone plan.

Remember to also take a hard look at your regular expenses such as dog walking, lawn care, house cleaning, laundry services, and home meal delivery services. All of these can be scrutinized for potential ‘freeze’ until you are back employed and financially back on your feet.

When you’re finding your footing on how to survive a layoff financially with the lifestyle you’ve been leading, all is fair game for cuts.

Explore The HealthCare Marketplace, Utilize Free Health Advisors

Many Marketplace plans offer more coverage at much less cost than COBRA coverage. A friend’s personal experience (kind enough to share). Her COBRA payment was $743 a month with United Health vs. $229 with Blue Cross Blue Shield at time of employment loss, Plus ZERO deductible.

You will want to check and see if your state’s unemployment insurance offers any health insurance benefits. Check with benefits.gov. This site will assist you in locating your local unemployment office.

Be sure to check out the governments options as well. These can be found on HealthCare.gov.

While you are finding your balance on how to survive a layoff financially you don’t need to get blindsided with any unexpected healthcare costs, or worse, emergencies.

Stop All Extra Payment Towards Getting Out Of Debt

While you are figuring out how to survive a layoff financially you want to have as much of your income available for necessities. These are things you need to live and keep a roof over your head.

Temporarily stop all extra payments towards your get out of debt plan. That’s right, stop overpaying the credit cards, mortgage, loans temporarily.

This is only during your layoff time. You’ll be able to resume overpayments soon, once you’re back to work. Remember, you are now practicing the ways of how to survive a layoff financially. You’re doing great!

Stop Any Automatic Savings Or Investment Plan Withdrawals

Call your bank or go to your online banking and stop any automatic savings or investment plan withdrawals. I know these are important, but the “how to survive a layoff financially” part means priorities need to be set on covering your very basic needs right now, the necessities list we talked about earlier.

Don’t Mope! Be Proud Enough Of Persevering To Grab Any Temporary Income Stream

Did you know in most states you can work while receiving unemployment insurance (weekly payments). Check your benefits and guidelines carefully. This is a great opportunity to add to your list of how to survive a layoff financially.

Some states allow you to earn up to a certain amount before it’s deducted from your benefits. Others allow this by hours worked. Some even have different rules for gig workers collecting unemployment insurance.

Check your local unemployment guidelines and call them if you are unclear. You may be missing out on some great opportunities to find work, network, and generally keep busy while you are surviving a layoff financially.

Take Advantage Of Online Work From Home Or Remote Jobs

Have you looked online for jobs lately? I mean before you got laid off? There are so many opportunities now. The world has made some drastic technology changes and many of them are sticking. Remote positions are one of these changes. There are a LOT of opportunities out there these days! Check out the usual sites we mentioned before like Indeed.com, Monster.com, and ZipRecruiter.com, also your state’s local job listing (can be found through your state’s unemployment resource page).

Don’t stop there. Places like TaskRabbit and Fiverr have countless side-gig opportunities. Multiple side-gigs are a way of life for many freelancers these days, so don’t count these out as a lucrative way of making a living.

Finding new clients, even interviews is a good way to network also. While this job, gig may not be the one you land, it could lead to bigger and better.

Conclusion:

Remember getting laid off is not the end of the world by any means no matter how insurmountable it might feel in the moment. It is definitely rare to find a person who goes through life never experiencing a job loss for one reason or another! The experience can be a blessing in many ways and propel you to bigger and greater things in life, possibly pursuing a career that you love so that you never “work” again.

Knowing what to do and taking charge when you get laid-off will give you a sense of freedom and a purpose. Be decisive and swift in your decisions and you will find that surviving financially was “easier done than said!”

Just think, some day when someone ask you “how to survive a layoff financially” ? You’ll take them by the hand and using your experience, tools and understanding to help guide them through a tough time.

If you are fortunate that you are still employed but Living Paycheck to Paycheck, be sure to check out the article on how to stop the vicious cycle now!